Cost Estimation for Chemical Plants

Estimate CAPEX, OPEX, and Margins Instantly — Visualize BFDs and Customize Economic Outputs in One Smart Platform

Why Use ChemFrame for Cost Estimation?

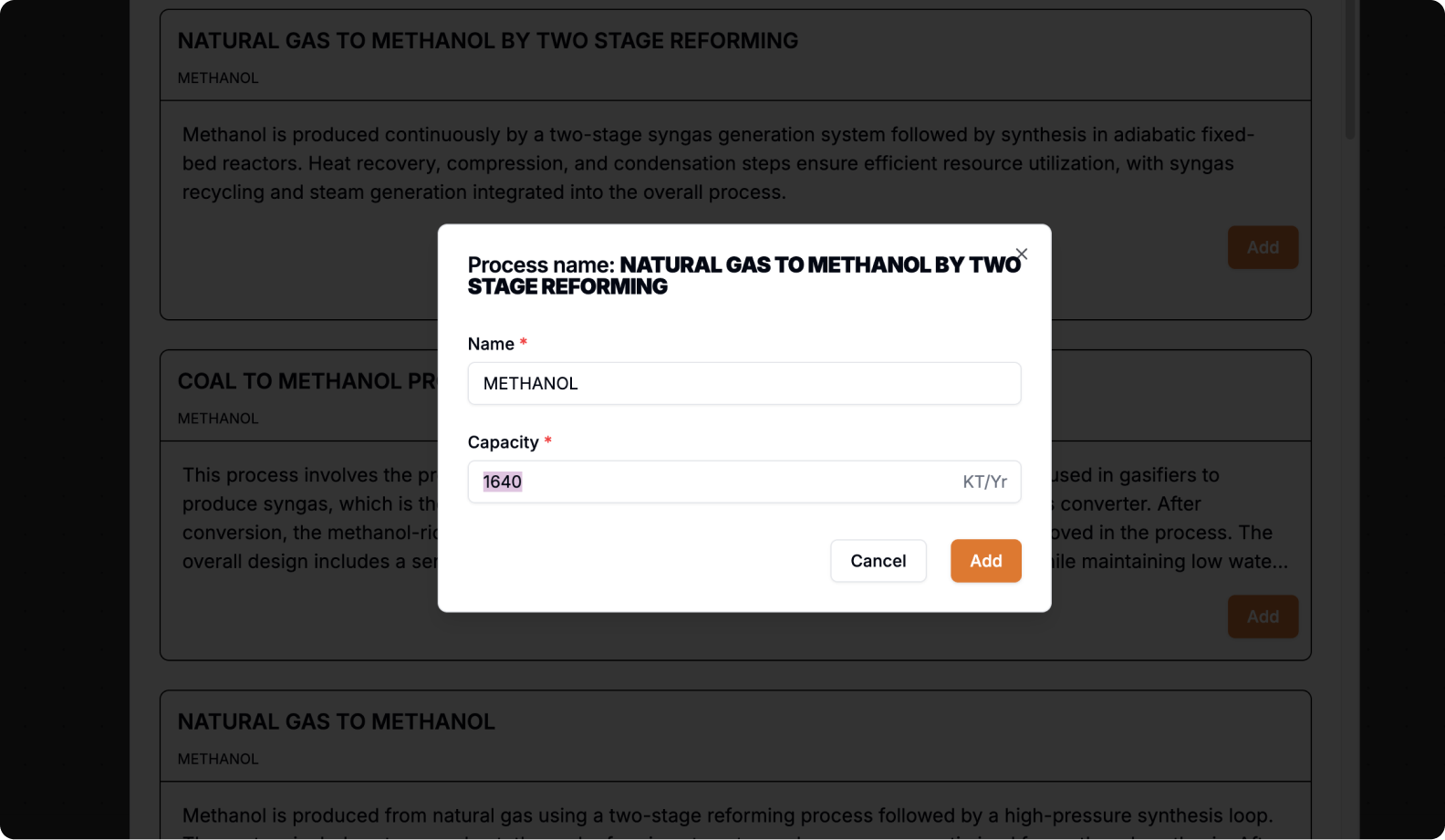

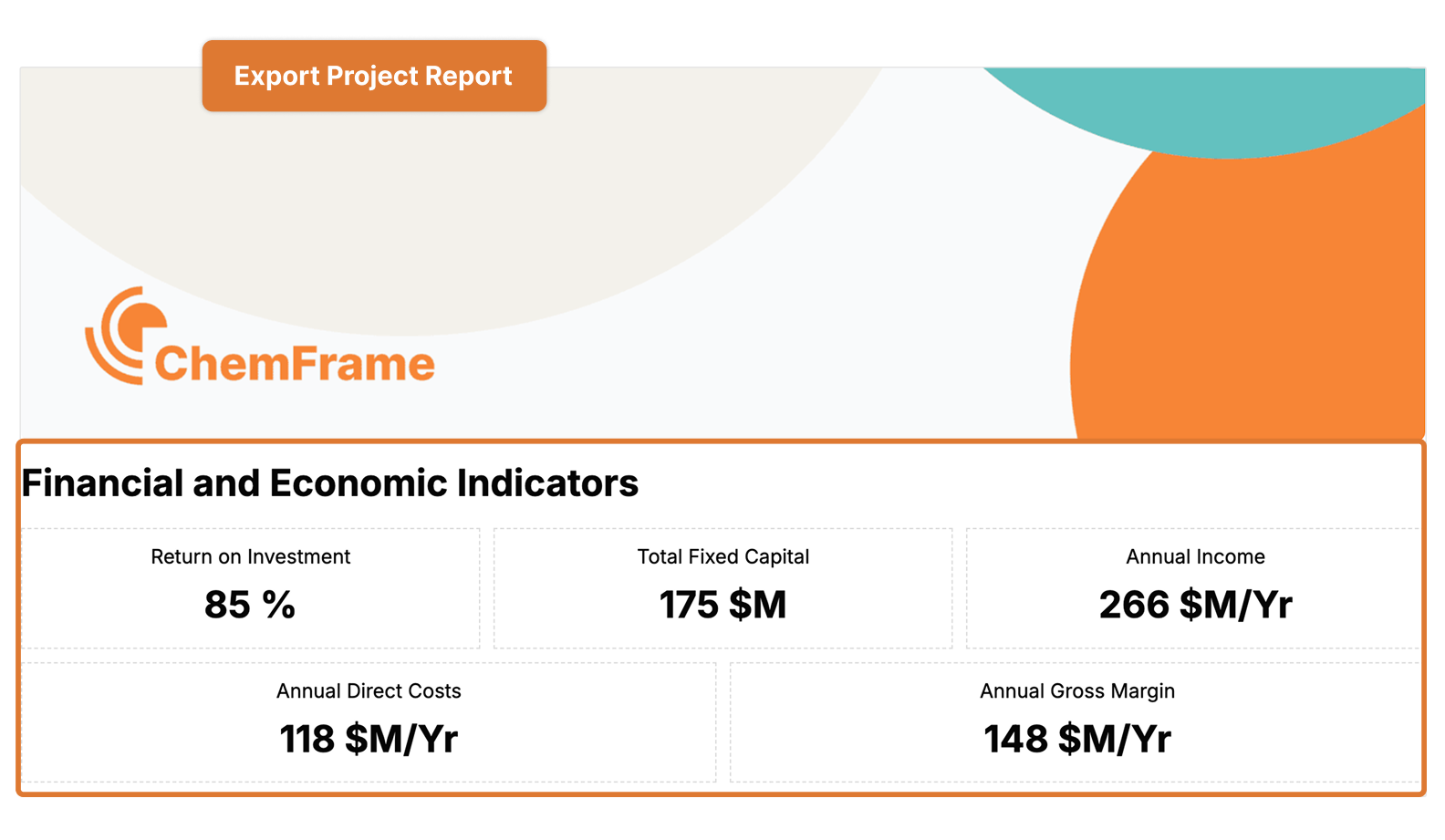

Instant CAPEX & OPEX Estimates

Get rapid estimates for total fixed capital and operating costs by simply selecting your plant and production capacity — no detailed inputs required.

Reduce Early Design Time

Skip time-consuming cost estimation exercises — start with pre-modeled plants and focus your energy on feasibility, risk, and strategy.

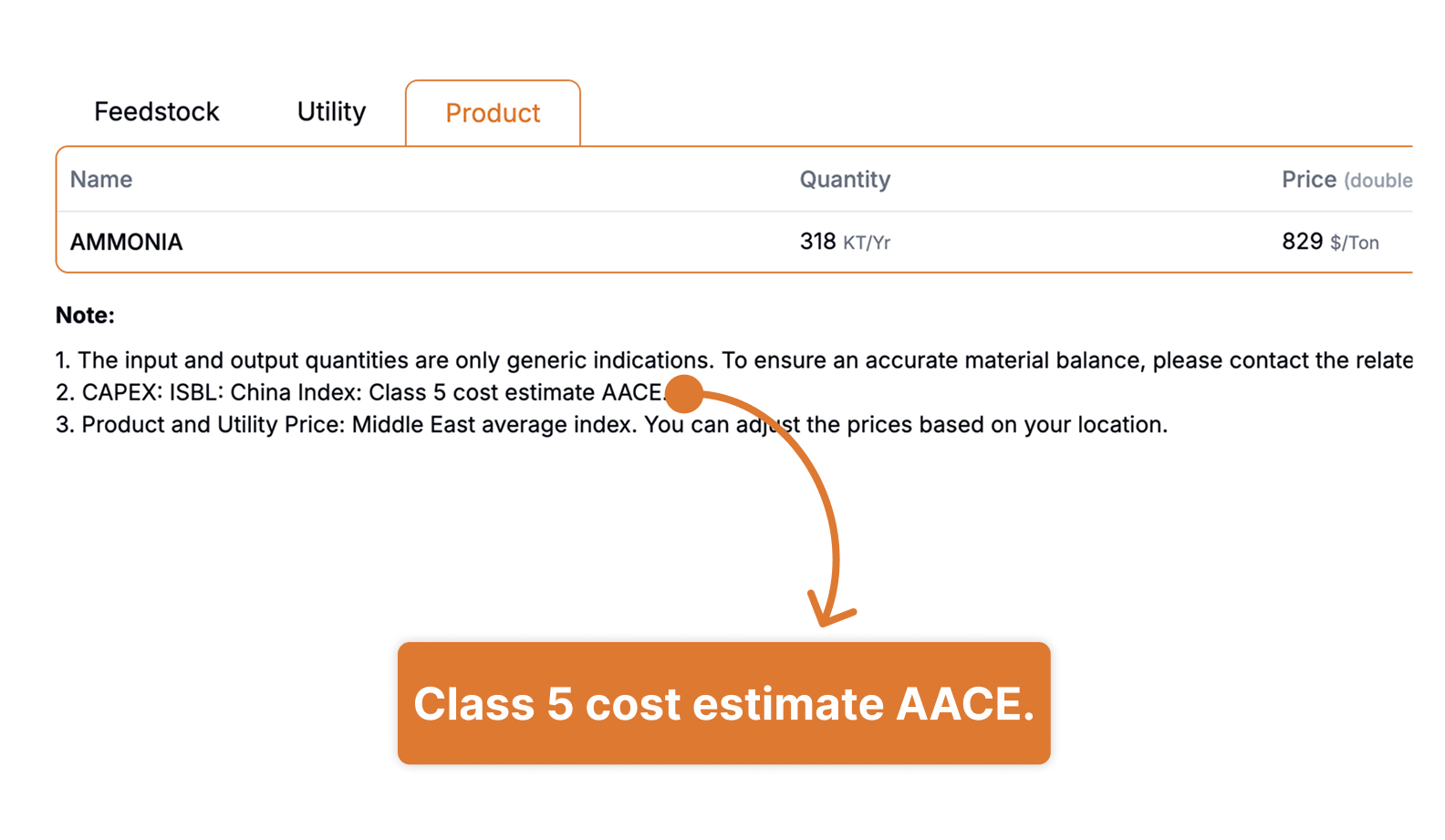

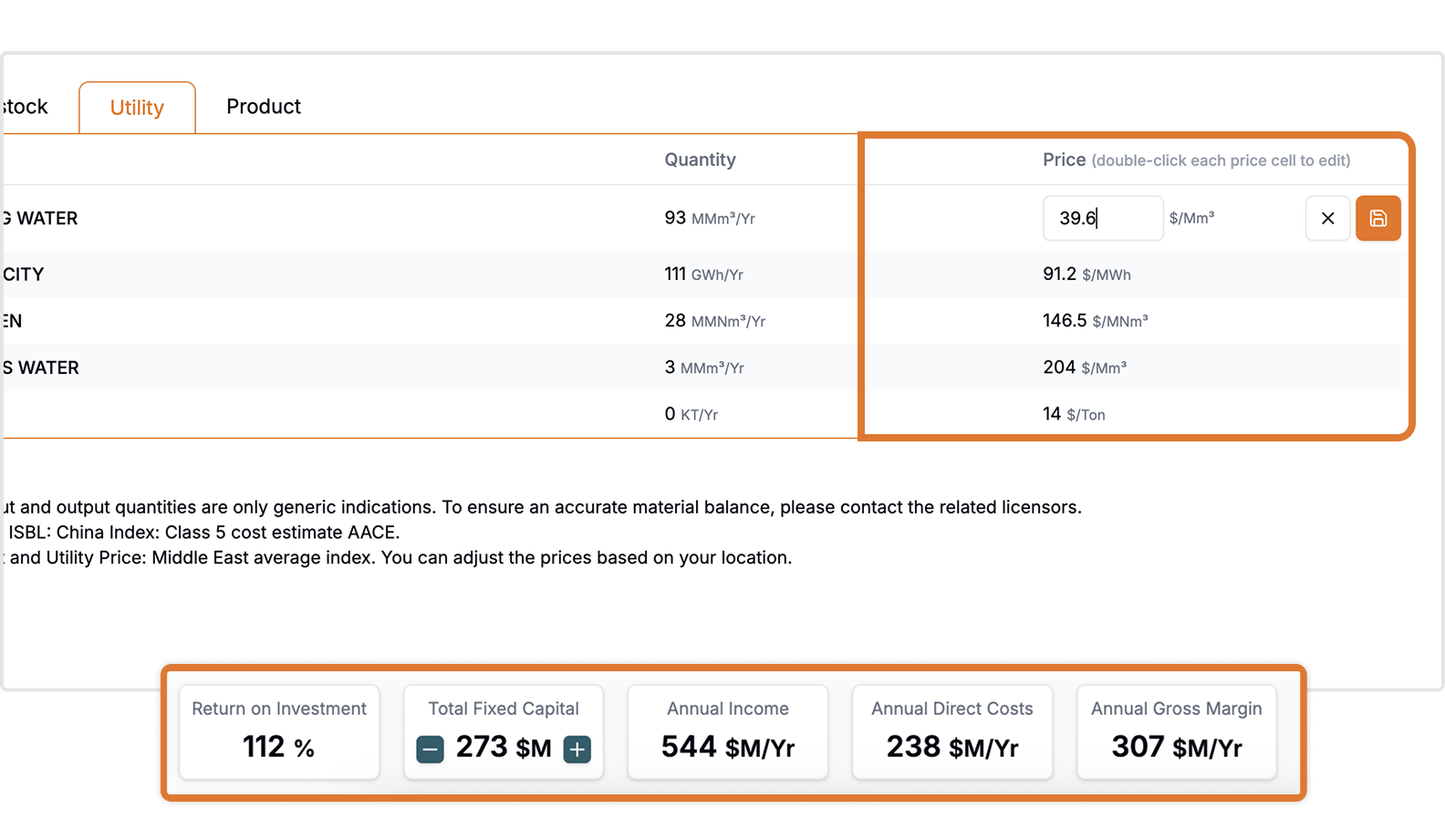

Custom Pricing for Any Region

Adjust feedstock, utility, and product prices in the spreadsheet to match your target region — watch ROI and gross margin update in real time.

Investor-Ready Dashboards

Export clean, professional PDF reports with total fixed capital, direct costs, and margin metrics for easy stakeholder communication.

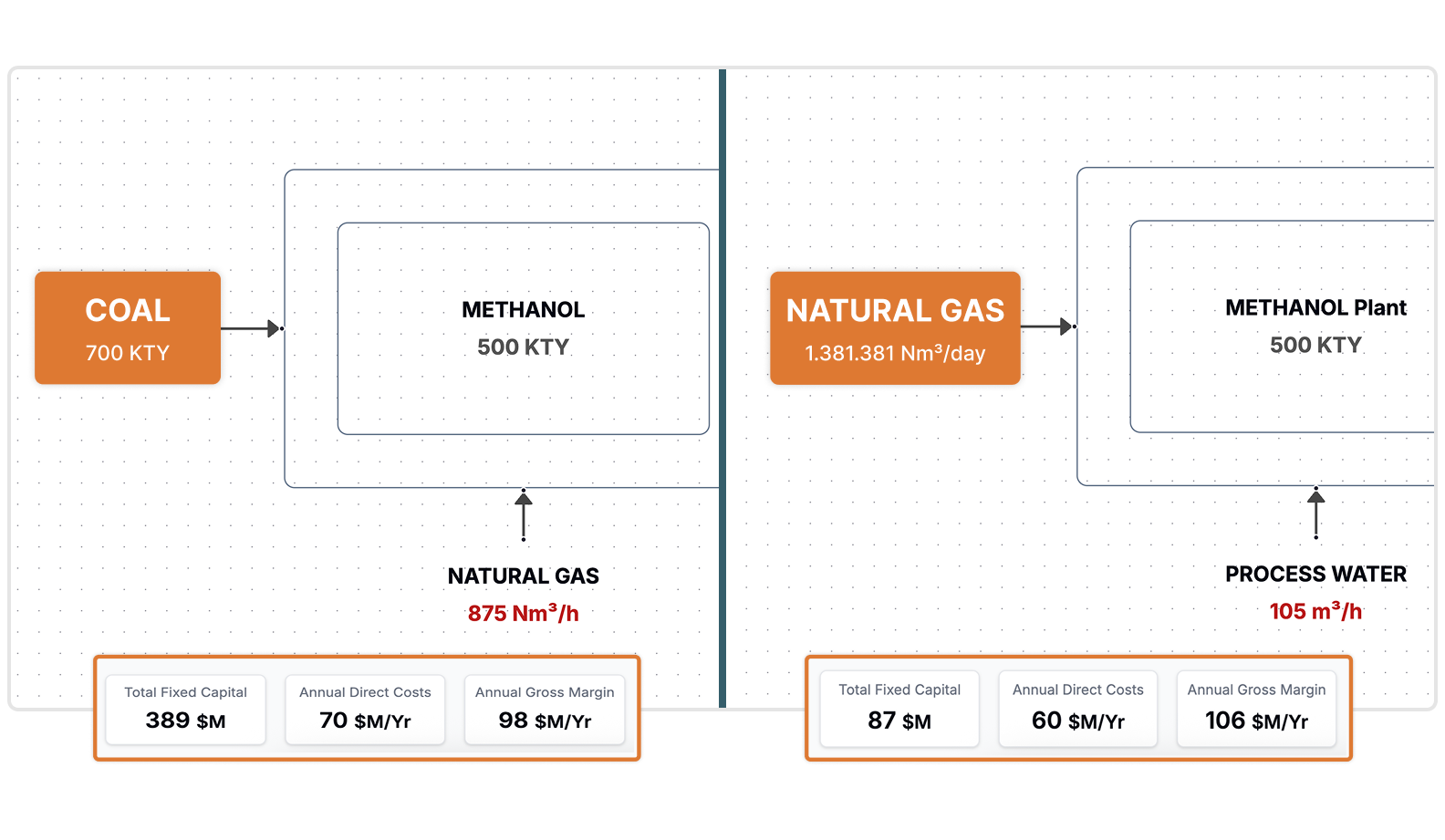

Compare Tech Pathways Easily

Evaluate competing plant options based on high-level economic output — optimize early-stage decisions across multiple scenarios.

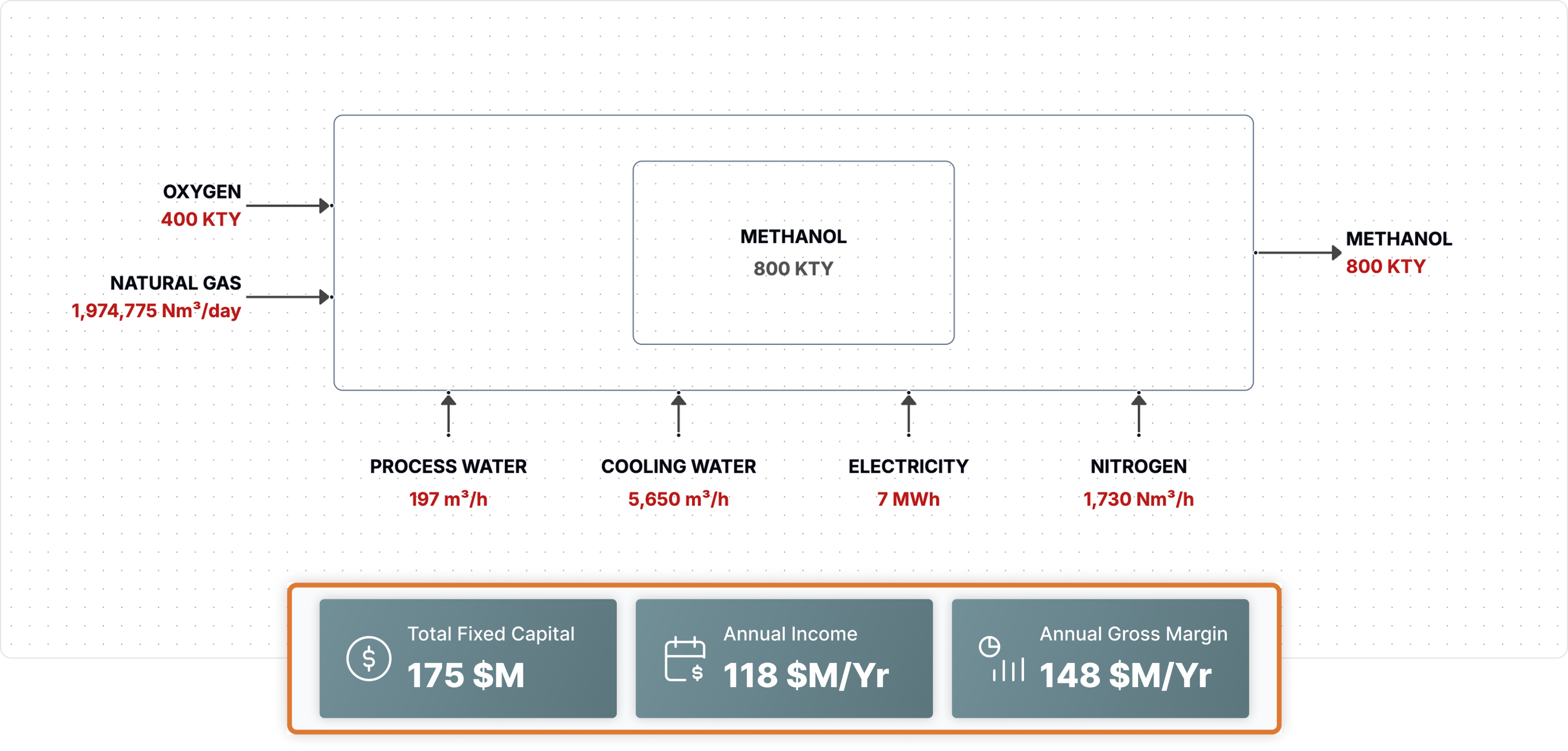

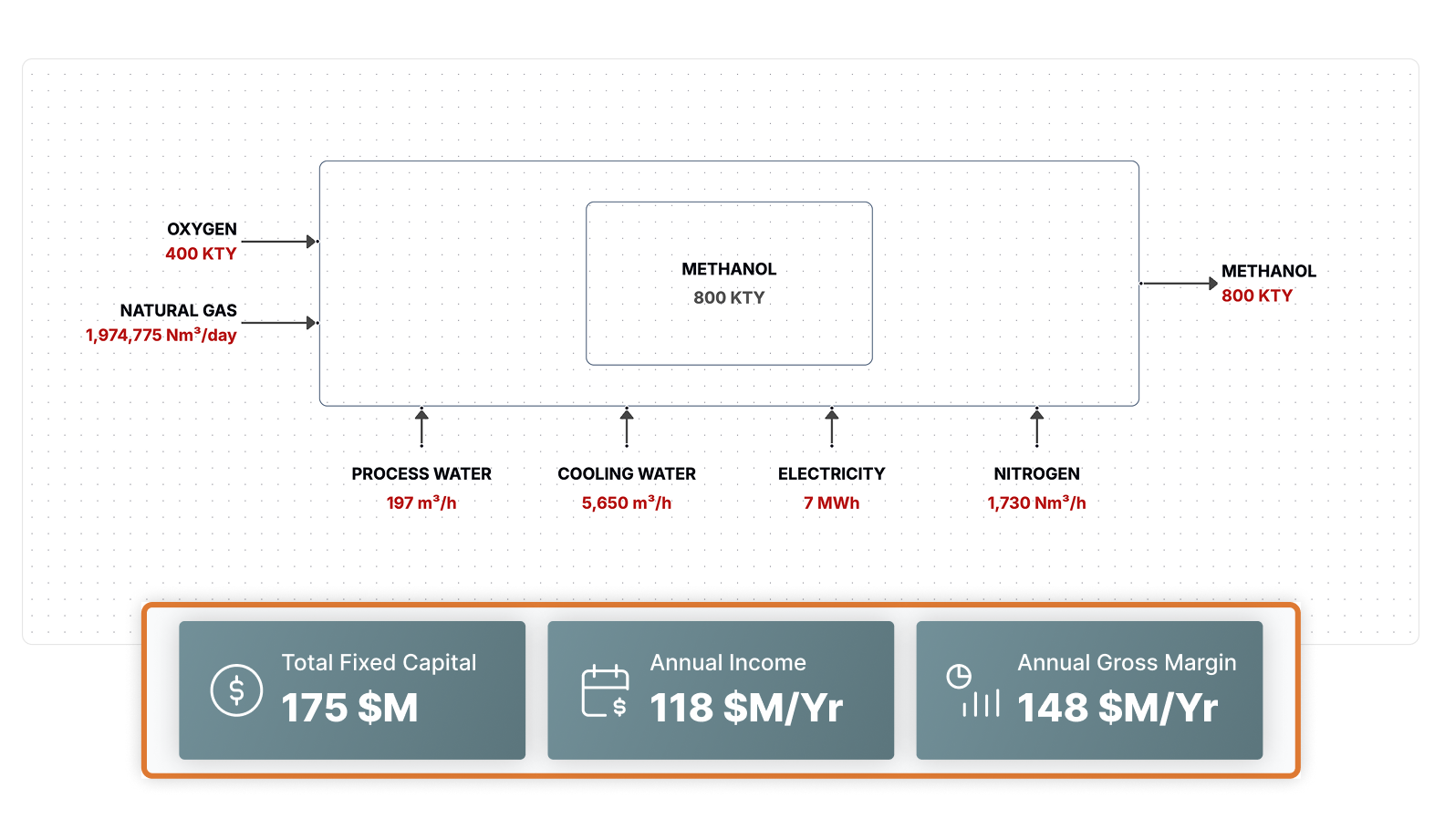

Visual Cost Mapping in BFDs

See key economic indicators directly on your Block Flow Diagram — understand cost drivers as you build or modify your plant.

Who is The ChemFrame Chemical Plant Cost Estimator for?

Invest with Confidence from Day One

ChemFrame helps investors quickly evaluate and compare oil, gas, and petrochemical opportunities — all with clear economics and early technical visibility.

- Assess opportunities using built-in economic metrics and process visualizations.

- De-risk early-stage decisions with access to BFDs and material balances.

- Discover strategic fits across products, locations, and stakeholders.

Back Capital Decisions with Real Economics

Financial institutions gain fast access to high-level cost structures, helping them validate the financial viability of proposed industrial projects.

- Review CAPEX, OPEX, and margin metrics instantly by plant and capacity production.

- Validate funding risks with region-specific material price customization.

- Simplify due diligence with ready-to-export economic dashboards.

License Smarter with Instant Metrics

ChemFrame allows licensors to present their technologies with economic clarity — supporting better client engagement and faster decision cycles.

- Demonstrate ROI and margin potential for licensed technologies at multiple capacities.

- Speed up client conversations using pre-built BFDs and economic indicators.

- Align technology pitch with regional price sensitivities and utility scenarios.

Accelerate FEL with Visual Economics

FEED consultants can use ChemFrame to validate early design decisions and create faster project screenings with reliable economic baselines.

- Start cost models with built-in capital and operating estimates.

- Customize inputs for feedstock and product prices to reflect project location.

- Quickly visualize trade-offs across competing BFD configurations.

Secure Strategic Supply with Confidence

Off-takers can analyze upstream economics to make smarter sourcing decisions and support long-term contract alignment.

- Review gross margins and cost drivers for potential supplier projects.

- Assess production viability across different technologies and scales.

- Align sourcing strategies with economically sustainable projects.

Unlock New Demand Paths for Your Feedstock

ChemFrame helps feedstock suppliers discover high-margin downstream uses of their materials and build stronger commercial partnerships.

- Identify process configurations that rely heavily on your feedstock.

- Evaluate the economics of downstream demand opportunities.

- Engage partners with data-driven insights on value-chain performance.