Acetaminophen Production in Global Healthcare

Acetaminophen (APAP), also known as paracetamol, is one of the most widely used analgesics and antipyretic drugs worldwide. It was first synthesized in the 19th century (initially reported by Charles Gerhardt in 1852 and later by Harmon Northrop Morse in 1878). It became commercially important in the 20th century as a safer alternative to Aspirin. Today, Acetaminophen is listed on the WHO Model List of Essential Medicines, reflecting its critical role in global healthcare. The industrial acetaminophen production is primarily based on the nitrobenzene route, in which nitrobenzene is hydrogenated to produce p-aminophenol (PAP), followed by acetylation with acetic anhydride to yield acetaminophen.

Key Properties of Acetaminophen

Here are some important details about acetaminophen:

- Molecular Formula: C8H9NO2

- Synonyms: Paracetamol, APAP

- CAS Number: 103-90-2

- IUPAC Name: N-(4-hydroxyphenyl)acetamide

- Molecular Weight: 151.16 g/mol

- Appearance: White Crystalline Powder

- Solubility: Slightly soluble in water, freely soluble in alcohol and acetone

- Global Market Size (2024): USD 10.4 billion

- Global Market Growth: from USD 11.2 billion (2025) to USD 16.6 billion (2034)

- Major Producers: India, USA, China

- Key Applications: Analgesics, antipyretics, cold and flu combinations

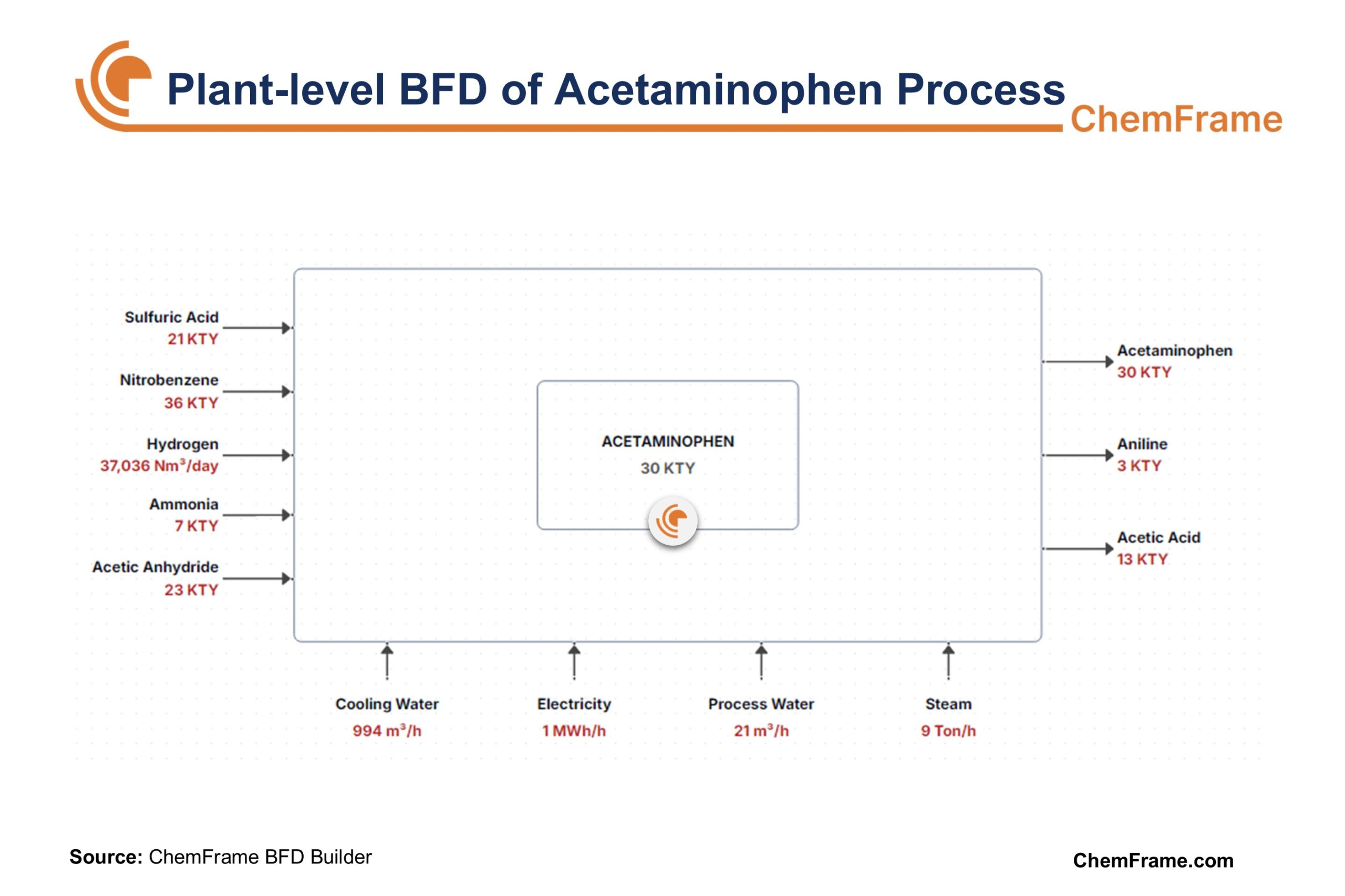

Acetaminophen Production Process

The industrial synthesis of acetaminophen is divided into 4 main stages:

- Hydrogenation of Nitrobenzene

Nitrobenzene, as the main feedstock, is hydrogenated in dilute sulfuric acid, typically at ~85 °C, using a catalyst such as platinum or palladium on carbon. The reaction is carried out in multiple continuous stirred-tank reactors (CSTRs) to maximize p-aminophenol formation and minimize o-aminophenol and aniline byproducts. This is the first step in the process.

Reaction: C₆H₅NO₂ + 3 H₂ → C₆H₄(NH₂)OH + H₂O

- Purification of p-Aminophenol

The hydrogenation mixture contains PAP, sulfuric acid, and impurities. pH and temperature are adjusted to selectively precipitate PAP. Crude PAP crystals are separated, washed, and recrystallized to pharmaceutical purity, which is essential for downstream acetylation in acetaminophen production. - Acetylation of p-Aminophenol

Purified PAP is acetylated with acetic anhydride in aqueous slurry at ~60 °C. Acetaminophen crystallizes out of the solution and is recovered by filtration, dried, and milled to meet pharmaceutical specifications. This step is critical in the overall process.

Reaction: C₆H₄(NH₂)OH + (CH₃CO)₂O → C₆H₄(NHCOCH₃)OH + CH₃COOH

- Byproduct and Solvent Recovery

Acetic acid generated in acetylation is recovered by distillation and reused. Aniline and other byproducts from hydrogenation are separated and either sold as intermediates or treated. Solvents and process water are recovered and recycled, improving cost efficiency and reducing environmental impact.

Acetaminophen Process Licensors

Historically, acetaminophen production technologies were protected by patents, particularly around the nitrobenzene hydrogenation process, catalyst systems, and purification techniques for p-aminophenol (PAP). Notable examples include mid-20th-century patents covering selective hydrogenation using Pt/C or Ni catalysts and crystallization methods to achieve pharmaceutical-grade purity. Many of these disclosures — such as US6403833B1 (2001) — have long since expired, and the core acetaminophen production process (nitrobenzene → PAP → acetaminophen) is now fully public.

While some more recent filings (e.g., CN103113254A, 2013) propose incremental process improvements, they do not change the fact that the basic synthesis is widely accessible. As a result, there are no active technology licensors in the acetaminophen market today. Unlike petrochemicals, where proprietary process licensing dominates, acetaminophen production relies on in-house development or engineering contractors.

The industry’s leadership has instead shifted to API manufacturers that maintain Drug Master Files (DMFs) with regulatory authorities such as the US FDA and European Medicines Agency (EMA). Holding an active DMF is now the primary determinant of competitiveness. For example, companies such as Atabai Kimya Sanayi Ve Ticaret As (DMF 6267, Turkey, since 1986), Meghmani LLP (DMF 30244, India, since 2016), Anqui Luan (DMF 24887, China, since 2011), and Adare Pharmaceuticals (DMF 33721, US, since 2019) hold DMFs for acetaminophen, confirming compliance with Good Manufacturing Practices (GMP) and international pharmaceutical standards. Buyers source APIs from these suppliers based on regulatory approval status, reliability, cost efficiency, and production scale rather than proprietary technology. Consequently, the competitive advantage in acetaminophen production is no longer technology-driven, but rooted in regulatory compliance, cost leadership, large-scale capacity, and increasingly in sustainable manufacturing practices.

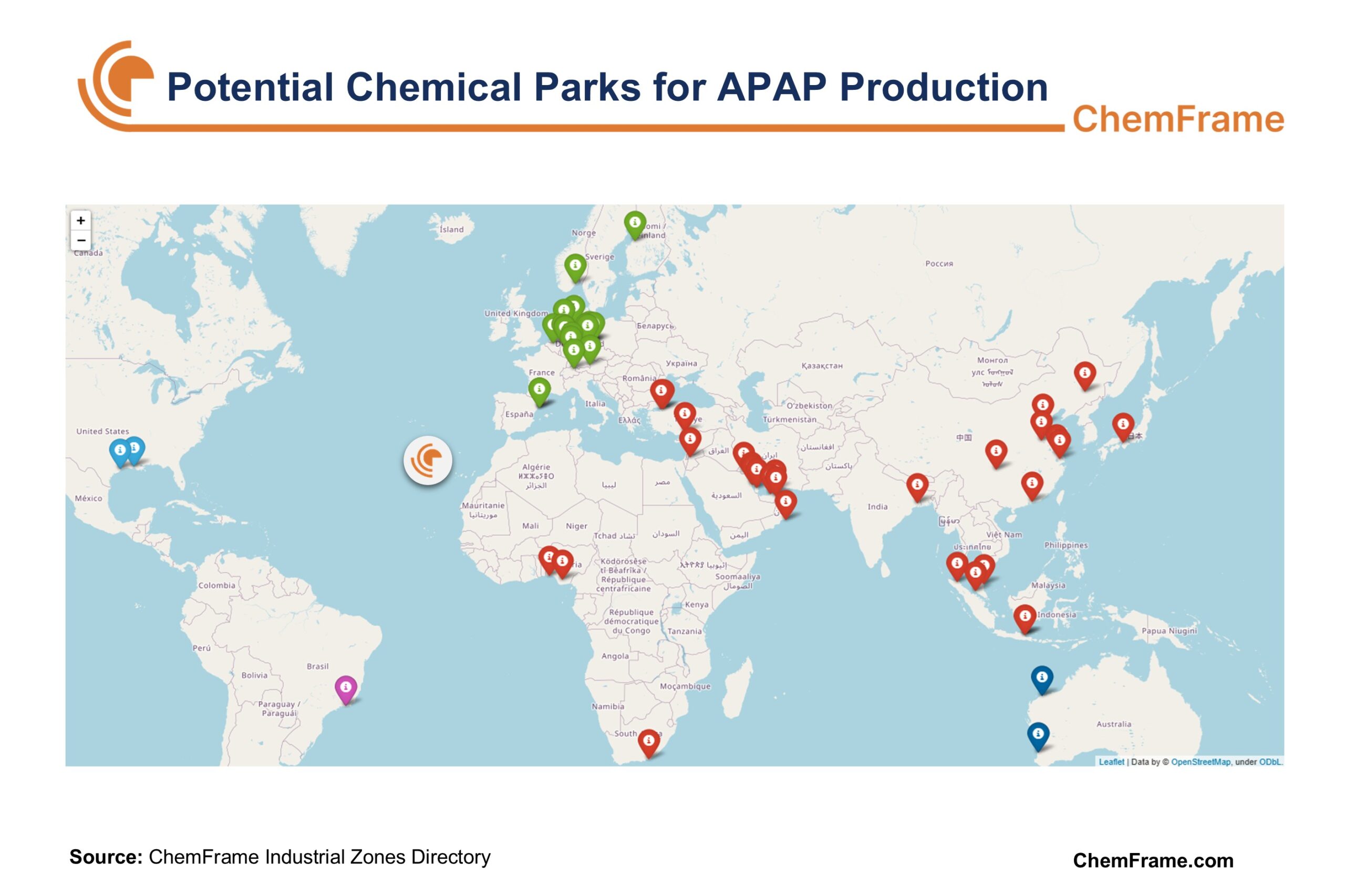

Chemical Industrial Parks for Acetaminophen Production

The development of acetaminophen production capacity is influenced by the industrial ecosystem in which the project is located. Access to essential raw materials such as nitrobenzene, hydrogen, and acetic anhydride, as well as integration with petrochemical, fine chemical, and pharmaceutical clusters, plays a critical role in determining investment feasibility. In the following, it will be examined how these factors manifest across various regions, including Asia, Europe, Africa, and the Americas.

Asia

Asia is a major hub for acetaminophen production, with several chemical industrial parks providing strong advantages in terms of feedstock availability, infrastructure, and proximity to pharmaceutical markets.

Hanshin Industrial Region (Japan)

- Access to key feedstocks: Benzene, Hydrogen, and Acetic Acid

- Annual Benzene Production Capacity: > 1 million tons

- Kobe Port handles > 6 million tons of chemicals annually, supporting efficient logistics.

- Close to pharmaceutical hubs in Osaka and Kyoto.

- Provides access to key pharmaceutical offtakers such as Taisho Pharmaceutical and Daiichi Sankyo.

GEBKIM Chemical Industrial Park (Turkey)

- Strong access to feedstocks: benzene, hydrogen, and acetic acid.

- Annual benzene production capacity: >800,000 metric tons.

- Robust petrochemical infrastructure and efficient logistics networks.

- Well-positioned for seamless movement of raw materials and finished products.

Visakhapatnam SEZ (India)

- Major hub for active pharmaceutical ingredients (APIs).

- Access to key feedstocks: benzene, hydrogen, and acetic acid.

- Annual chemical throughput: >1.5 million tons, ensuring reliable feedstock supply.

- Visakhapatnam Port enables smooth logistics for imports/exports.

- Strong pharmaceutical sector and established API manufacturing capacity.

- Benefits from cost-effective labor and a favorable regulatory environment.

Shanghai Chemical Industry Park (China)

- Access to essential feedstocks: benzene, hydrogen, and acetic acid.

- Annual benzene production capacity: >1.2 million metric tons, ensuring a stable supply.

- Excellent connectivity with direct access to the Port of Shanghai, one of the world’s largest ports.

- Proximity to Shanghai’s pharmaceutical manufacturing base supports strong acetaminophen demand.

- Provides access to local pharmaceutical offtakers.

Europe

Europe’s chemical industrial parks are characterized by integrated chemical supply chains and advanced pharmaceutical ecosystems, making them ideal for acetaminophen production.

BASF Ludwigshafen (Germany)

- World’s largest integrated chemical complex.

- Annual benzene production capacity: >1.2 million metric tons.

- Equipped with advanced production capabilities for hydrogen and acetic acid.

- Located in Germany, a hub for Europe’s chemical and pharmaceutical industries.

- Benefits from seamless logistics via the Port of Ludwigshafen.

- Proximity to major pharmaceutical players: Bayer and Sanofi.

Industriepark Höchst (Germany)

- Leading site for fine chemicals and pharmaceuticals.

- Direct access to feedstocks: benzene, hydrogen, and acetic acid.

- Annual chemical production capacity: >3 million metric tons.

- Near Frankfurt, Europe’s largest pharmaceutical market.

- Strong local demand supported by pharmaceutical giants such as Sanofi and BASF.

Chemiepark Bitterfeld-Wolfen (Germany)

- Major European site for API and fine chemical production.

- Access to key feedstocks: benzene, hydrogen, and acetic acid.

- Annual chemical throughput: >2 million tons.

- Strategic location in Saxony-Anhalt, well-connected to transportation hubs.

- Provides efficient distribution for domestic and international markets.

- Strong links to the European pharmaceutical ecosystem, ensuring reliable offtakers.

Port of Antwerp-Bruges (Belgium)

- One of Europe’s largest chemical clusters.

- Access to key feedstocks: benzene, hydrogen, and acetic acid.

- Annual chemical handling: >10 million tons.

- Functions as Belgium’s primary petrochemical hub with strong logistics.

- Strategically connected to pharmaceutical markets in Germany, France, and the Netherlands.

- Proximity to major pharmaceutical players: GSK and Bayer.

Africa

In Africa, select chemical industrial parks offer varying potential for acetaminophen production. These zones provide opportunities for feedstock access, infrastructure development, and pharmaceutical sector growth.

Suez Canal Economic Zone (SCZONE, Egypt)

- Strategic access to feedstocks: benzene, hydrogen, and acetic acid.

- The advantage of proximity to the Suez Canal, one of the world’s busiest trade routes.

- Growing pharmaceutical sector in Egypt with key players: EIPICO and Amoun Pharmaceutical.

- Ensures stable demand for acetaminophen.

- Strong logistical advantages support API production.

Coega SEZ (South Africa)

- Access to essential feedstocks: benzene, hydrogen, and acetic acid.

- Strategically located near the Port of Ngqura, with direct access to international markets.

- Supported by South Africa’s established pharmaceutical sector.

- Key local players: Aspen Pharmacare and Adcock Ingram.

- Strong local demand for acetaminophen APIs, both domestic and export to neighboring countries.

Americas

The Americas offer significant opportunities for acetaminophen production, combining major petrochemical hubs with large pharmaceutical markets.

Bayport Industrial District (Texas, USA)

- Part of the Houston petrochemical cluster.

- Annual benzene production capacity: >1.5 million metric tons.

- Proximity to the Port of Houston, one of the busiest U.S. ports, ensures efficient logistics.

- Close to major pharmaceutical hubs in Texas.

- Key pharmaceutical players: Pfizer and Johnson & Johnson, ensuring steady acetaminophen demand.

Freeport Complex (Texas, USA)

- Anchored by Dow Chemical, one of the world’s largest chemical producers.

- Major global site for aromatics and acetic acid production.

- Annual acetic acid production capacity: >3 million metric tons.

- Located near the Port of Freeport, ensuring robust logistics.

- Extensive feedstock availability supports large-scale acetaminophen production.

- Strong pharmaceutical demand from companies like Perrigo and Teva Pharmaceuticals.

Across all these regions, key opportunities exist for enhancing the acetaminophen value chain. Expanding the local production of essential intermediates such as p-aminophenol (PAP) and acetic anhydride will ensure a steady and cost-effective supply of raw materials. Establishing acetaminophen production API plants within these chemical industrial parks can foster a more integrated and self-sufficient supply chain. Collaborations between the petrochemical, pharmaceutical, and biotechnology sectors will drive innovation, leading to cost reductions, higher efficiency, and improved environmental outcomes.

Off-takers of Acetaminophen

Off-takers represent the demand side of the value chain, encompassing both multinational pharmaceutical companies and regional manufacturers that integrate acetaminophen production into finished dosage forms. Their purchasing power, regulatory approvals, and distribution networks determine the sustainability of new production investments.

Asia

Asia remains a dominant force in the global acetaminophen production market, both in production and consumption. While exact figures vary, the region’s substantial manufacturing capabilities and widespread use contribute significantly to global supply and demand. Key players include:

- Sun Pharma (India): Sun Pharma is one of the top 10 pharmaceutical companies globally, with $5.2 billion in revenue from generics and APIs in 2023. It supplies acetaminophen production formulations to over 100 countries, and its facilities in over 20 countries include production plants in the U.S. and Europe.

- Shanghai Pharma (China): Shanghai Pharma, with a 2023 revenue of $11 billion, is a dominant player in China’s pharmaceutical market. The company produces over 200 million acetaminophen tablets annually and holds a significant share of the Chinese market while also exporting to Asia and Europe.

- Taisho Pharmaceutical (Japan): A leader in Japan’s over-the-counter (OTC) medications, Taisho generates $2.1 billion in revenue from OTC and prescription drugs. It produces nearly 1 billion acetaminophen tablets annually, with a strong presence in the Japanese market for cold and flu treatments.

Europe

Europe’s offtakers strike a balance between global branded multinationals and generic producers.

- Sanofi (France): A leading global consumer of acetaminophen production, Sanofi’s Doliprane brand drives significant demand in Western Europe. The company sells over 200 million units of Doliprane annually. Sanofi’s global revenue in 2023 was $42 billion, with a strong contribution from acetaminophen-based OTC products.

- Bayer (Germany): Bayer incorporates acetaminophen into several flagship products like aspirin-paracetamol combinations. The company generates over $1.5 billion annually from these products, with a dominant position in the European market.

- GSK (UK): Known for its Panadol brand, GSK maintains steady demand for acetaminophen both in Europe and globally. GSK’s 2023 global revenue was $50 billion, with significant revenue from its acetaminophen-based products like Panadol.

Americas

The Americas, with their large pharmaceutical markets, present significant demand for acetaminophen.

- Johnson & Johnson (USA): The largest global consumer of acetaminophen, Johnson & Johnson dominates the market with its flagship Tylenol brand. Tylenol generates billions of dollars in annual revenue, making J&J the leading offtaker in the Americas, with substantial market share across North America.

- Pfizer (USA): Pfizer incorporates acetaminophen into combination products like Advil Dual Action. These products are particularly popular in North America, contributing significantly to Pfizer’s revenue. In 2023, Pfizer’s total revenue was $100 billion, with a large portion driven by its pain relief product lines.

- Perrigo (USA): A key player in private-label and contract manufacturing, Perrigo sources large quantities of acetaminophen for its branded and private-label products. The company has an extensive presence in North America, particularly in the OTC segment.

- EMS Pharma (Brazil): One of the leading pharmaceutical companies in Latin America, EMS Pharma integrates acetaminophen into high-volume OTC formulations. The company holds a strong position in Brazil and other Latin American markets, with substantial sales in the acetaminophen segment.

Africa

In Africa, regional pharmaceutical champions are key in driving demand for acetaminophen APIs.

- Aspen Pharmacare (South Africa): As Africa’s largest pharmaceutical company, Aspen Pharmacare is a major consumer of acetaminophen APIs. The company plays a crucial role in both local and export markets, sourcing significant volumes of acetaminophen for its OTC and prescription products. Aspen is pivotal in driving demand in regions with less developed pharmaceutical ecosystems, ensuring a steady supply across Southern Africa and beyond.

Conclusion

At ChemFrame, we believe that acetaminophen remains a cornerstone of global healthcare, widely used for its analgesic and antipyretic properties. Industrial acetaminophen production is well-established and standardized, primarily following the nitrobenzene → p-aminophenol → acetaminophen route, with no active technology licensors currently controlling the market. Competitive advantage now depends on regulatory compliance, large-scale capacity, cost efficiency, and sustainable practices rather than proprietary technology.

Chemical industrial parks across Asia, Europe, Africa, and the Americas provide strategic advantages for acetaminophen production, including access to feedstocks, integrated supply chains, advanced logistics, and proximity to pharmaceutical hubs. These ecosystems support both efficient manufacturing and reliable supply to the majority of off-takers.

Global demand is driven by a mix of multinational pharmaceutical companies and regional leaders, with Asia, Europe, and the Americas representing the largest consumption markets, and Africa emerging as a growth region through regional pharmaceutical champions. Future opportunities lie in enhancing local production of intermediates, integrating API manufacturing with chemical parks, and fostering collaborations across petrochemical, pharmaceutical, and biotech sectors to improve efficiency, cost-effectiveness, and sustainability.

FAQs

- What is acetaminophen, and why is it important in healthcare?

Acetaminophen (paracetamol or APAP) is a widely used analgesic and antipyretic drug, listed on the WHO Model List of Essential Medicines. ChemFrame provides insights into global production trends and key pharmaceutical applications of acetaminophen. - How is acetaminophen produced industrially?

Industrial production follows the nitrobenzene → p-aminophenol → acetaminophen route, including hydrogenation, purification, acetylation, and byproduct recovery. ChemFrame maps these processes in industrial flowcharts to guide investment and operational planning. - What are the key chemical properties of acetaminophen?

Acetaminophen has the molecular formula C8H9NO2, molecular weight 151.16 g/mol, and appears as a white crystalline powder. - Which countries are the largest producers of acetaminophen?

India, the USA, and China lead acetaminophen production globally. ChemFrame highlights production hubs, chemical park capacities, and regional advantages for strategic sourcing and market analysis. - Are there any active technology licensors for acetaminophen production?

No active licensors exist, as core patents have expired. ChemFrame tracks historical patents, expired technologies, and regulatory compliance trends to support companies in planning in-house production or contract manufacturing. - What role do chemical industrial parks play in acetaminophen production?

Industrial parks provide access to feedstocks, logistics, and integrated supply chains. ChemFrame analyzes chemical park infrastructure worldwide, helping companies identify optimal sites for acetaminophen API plants. - Who are the major off-takers of acetaminophen APIs globally?

Major buyers include Sun Pharma, Shanghai Pharma, Taisho Pharmaceutical, Sanofi, Bayer, GSK, Johnson & Johnson, Pfizer, Perrigo, and Aspen Pharmacare. ChemFrame tracks offtaker networks, volumes, and regulatory approvals to guide supplier and market strategies. - How is acetaminophen production regulated and standardized?

Manufacturers maintain Drug Master Files (DMFs) with authorities like the US FDA and EMA. ChemFrame provides insights on DMF holders, compliance status, and competitive benchmarking for API suppliers. - What are the main applications of acetaminophen?

It is used in analgesics, antipyretics, cold/flu combinations, and prescription medicines. ChemFrame’s market data highlights global consumption trends and identifies emerging product opportunities. - What are future opportunities in the acetaminophen industry?

Opportunities include local production of intermediates, integration with chemical parks, sustainability improvements, and cross-sector collaboration. ChemFrame helps companies identify investment prospects, optimize supply chains, and evaluate the full acetaminophen value chain.